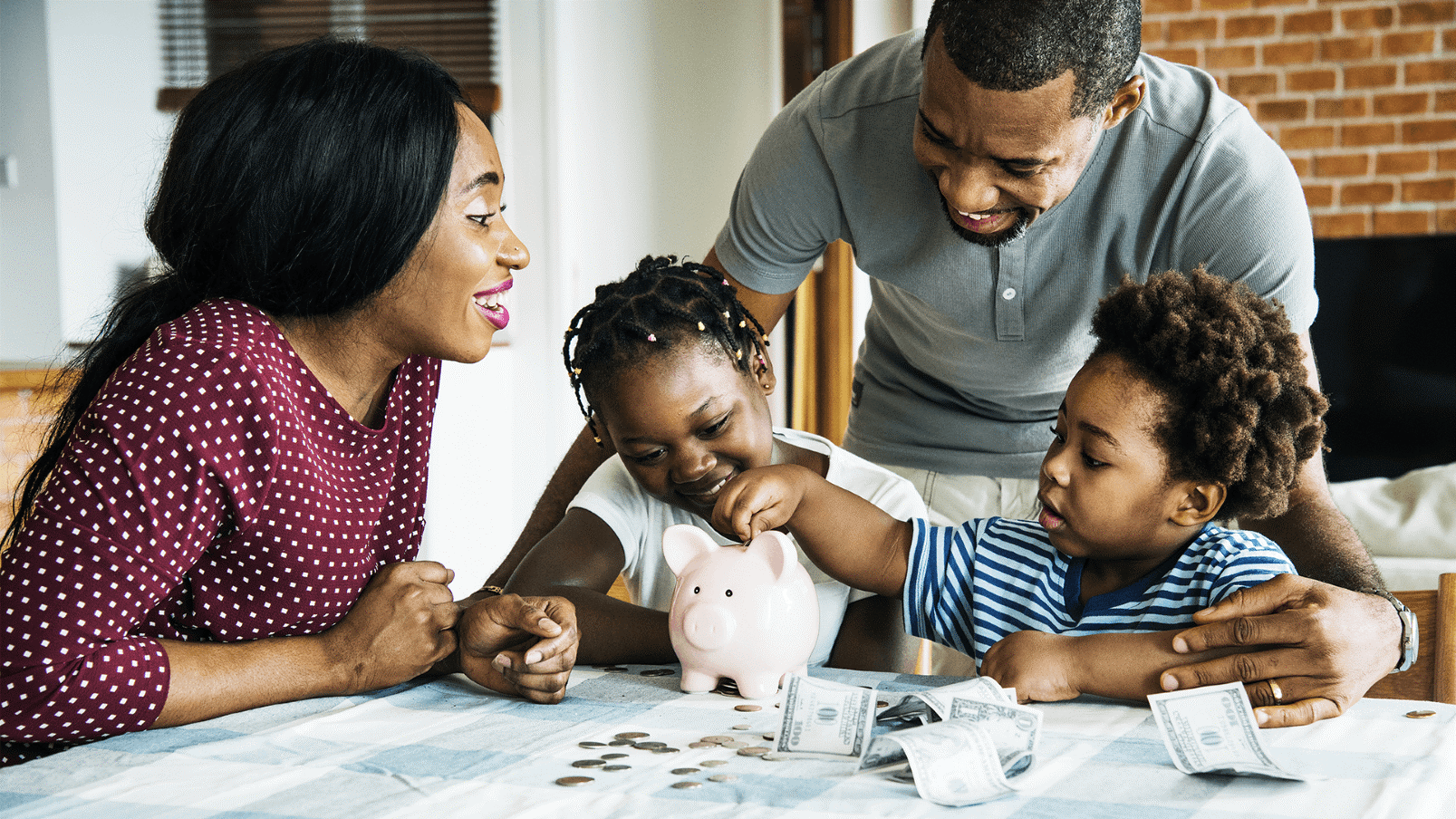

There are few things more exciting than the anticipation of having a baby or adopting a child into your family. As any expecting parents will attest, it can also be a stressful time, trying to take care of everything you need to get done. In addition to getting your home ready, you need to think about things like arranging for child care and adjusting health insurance benefits, so your entire family is covered.

Don't Forget About Your Life Insurance

When your family grows, it's also important to take a look at your existing life insurance coverage. When you bought life insurance initially, it was likely based on your family status at that point in time. You probably (with some help from your insurance professional) calculated how much insurance your loved ones would need if you were to die prematurely. Adding a new child to your family means those original calculations may no longer be enough to protect your family if the worst was to happen.

In addition to looking at the amount of life insurance protection you have, it's also a good idea to revisit the types of policies you have. While term insurance may have met your needs five to ten years ago, it may make sense to now consider purchasing a

universal life

policy because of the premium flexibility and cash value component those policies offer.

Protect Your Child's Future Insurability Through Life Insurance

After your baby arrives (or after an adoption is finalized), you should also consider whether it makes sense to purchase life insurance

coverage for your child

. There are several distinct advantages to doing so.

First, buying coverage is practical so that if the worst happened, you would have funds available to cover your child's final expenses. However, more than that, buying life insurance on a baby or young child is smart because it allows you to essentially lock in coverage now - while your child is healthy. If the policy is kept in force, no matter what happens to your child's health later in life, his or her insurance policy will be there as protection.

And, because life insurance premiums are based largely on the attained age at the time the policy is issued, buying life insurance for your child is inexpensive.

Finally, purchasing cash value life insurance for an infant or child allows you to fund the policy's cash value. Those funds can be helpful to your child later in his or her life - even during your child's retirement years.

Symmetry Financial Group Can Help

If you are expecting a new addition to your family, making the time to review and adjust life insurance coverage is important. When you're ready for that review, the insurance professionals at Symmetry Financial Group will be here to help.

Contact us

to learn more and connect with an agent to discover your coverage options.